Export Documents

Our Export Documentation services are an important asset for companies engaged in Arab-British trade. It is vital to fulfil all the documentation requirements accurately. Any errors could lead to costly delays when clearing goods through customs and postpone payment, with the potential to result in a non-payment scenario.

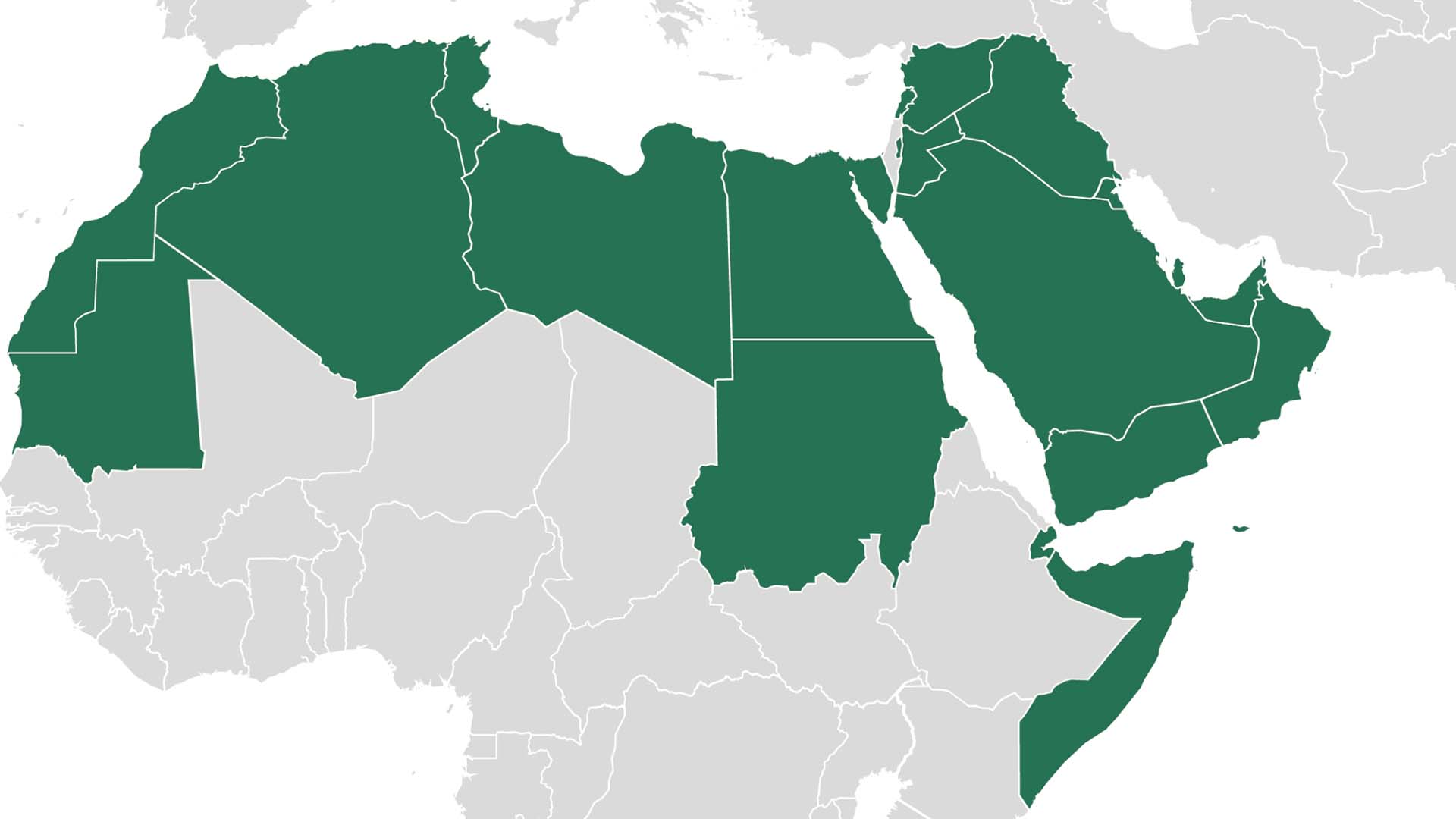

Exporting to the Arab World

Member governments of the League of Arab States entrust the Chamber with the task of standardising and co-ordinating the preparation and submission of commercial documents for the export of goods from the UK to their countries.

We provide the only Arab League endorsed certification services required for the export of goods to Arab countries. The Chamber’s unique export documentation service is an important asset to Arab-British trade. With our extensive experience, we are ideally positioned to assist exporters entering the Arab market, encompassing all your certification and legislation needs.

- ALGERIA

- BAHRAIN

- COMOROS

- DJIBOUTI

- EGYPT

- IRAQ

- JORDAN

- KUWAIT

- LEBANON

- LIBYA

- MAURITANIA

- MOROCCO

- OMAN

- PALESTINE

- QATAR

- SAUDI ARABIA

- SOMALIA

- SUDAN

- SYRIA

- TUNISIA

- UAE

- YEMEN

ABCC PRICE LIST

| ABCC CERTIFICATION | Price | VAT | Total | |

|---|---|---|---|---|

| Certification - Original | Member | £26.00 | £5.20 | £31.20 |

| Certification - Original | Non-Member | £62.00 | £12.40 | £74.40 |

| Certification - Copy | Member | £5.00 | £1.00 | £6.00 |

| Certification - Copy | Non-Member | £62.00 | £12.40 | £74.40 |

| Electronic Certification* - Original | Member only | £26.00 | £5.20 | £31.20 |

| Electronic Certification* - Copy | Member only | £5.00 | £1.00 | £6.00 |

*Electronic fees will apply

| FCDO LEGALISATION (Includes non-vatable FCDO Fee) | Price | VAT | Total | |

|---|---|---|---|---|

| FCDO Standard | Member and Non-Member | £66.00 | £5.20 | £71.20 |

| NOTARY & SOLICITOR | Price | VAT | Total | |

|---|---|---|---|---|

| Notarisation | Member and Non-Member | £51.00 | £10.20 | £61.20 |

| Solicitor | Member | £15.00 | £3.00 | £18.00 |

| Solicitor | Non-Member | £20.00 | £4.00 | £24.00 |

| ABCC TRANSLATION* | Price | VAT | Total | |

|---|---|---|---|---|

| Translation Certificate of origin | Member | £32.00 | £6.40 | £38.40 |

| Translation Invoice | Member | £42.00 | £8.40 | £50.40 |

| Translation Certificate of origin | Non-Member | £42.00 | £8.40 | £50.40 |

| Translation Invoice | Non-Member | £52.00 | £10.40 | £62.40 |

*For other documents please contact us

| SAUDI VISA LETTER CERTIFICATION | Price | VAT | Total | |

|---|---|---|---|---|

| Saudi Visa Letter | Member | £26.00 | £5.20 | £31.20 |

| Saudi Visa Letter | Non-Member | £31.00 | £6.20 | £37.20 |

| COURIER SERVICE | Price | VAT | Total | |

|---|---|---|---|---|

| Courier Service Fee | Member | £26.00 | £5.20 | £31.20 |

| Courier Service Fee | Non-Member | £26.00 | £5.20 | £31.20 |

| ABCC Blank Certificate, Alteration & Indemnity fees | Price | VAT | Total | |

|---|---|---|---|---|

| Blank Certificate of Origin - Original | Member and Non-Member | £1.00 | £0.20 | £1.20 |

| Blank Certificate of Origin - Copy | Member and Non-Member | £0.50 | £0.10 | £0.60 |

| Alteration | Member and Non-Member | £6.00 | £1.20 | £7.20 |

| Indemnity Letter | Member and Non-Member | £6.00 | £1.20 | £7.20 |

EMBASSY Legalisation fees and requirements

ALGERIA DOCUMENTATION REQUIREMENTS

Stream 1: Certificate of Origin and Invoice / Other Documents

Stream 2: Certificate of Origin and Invoice / Other Documents + EMBASSY COPY

| Document | Original | Copy |

|---|---|---|

| Certificate of origin | £60 | £5 |

| Invoice £ | 1/ (Invoice value x Algerian exchange rate) ÷ 10000 = X (rounded up to nearest £) 2/ X x 1.28 = Leg fee (rounded up to nearest £) | £5 |

| Invoice other currency | 1/ [(Invoice value ÷ GBP) x Algerian exchange rate] ÷ 10000 = X (rounded up to nearest £) 2/ X x 1.28 = Leg fee (rounded up to nearest £) | £5 |

| Other document | £60 | £5 |

Last updated 16th august 2021

BAHRAIN DOCUMENTATION REQUIREMENTS

Stream 1: Certificate of Origin and Invoice / Other Documents

Stream 2: Certificate of Origin and Invoice / Other Documents

For invoices in US dollars or Euro and other currency, these must be evaluated in pounds by multiplying the value of the invoice by the daily exchange rate in order to calculate the fees. • The Bahrain Embassy will only legalise Certificate of Origin which has been issued on a Bahrain Certificate of Origin, the ABCC will not certify it, courier fees apply. • The invoice must be certified by the ABCC.

| Document | Fee |

|---|---|

| Certificate of Origin (Original & Copy) | £85 |

| All Other Documents (Original & Copy) | £85 |

| Invoice (Original & Copy) | |

|---|---|

| Invoice value from 1 to 1000 BHD | £40 |

| Invoice value from 1001 to 5,000 BHD | £60 |

| Invoice value from 5,001 to 10,000 BHD | £120 |

| Invoice value from 10,001 to 20,000 BHD | £240 |

| Invoice value from 20,001 to 50,000 BHD | £360 |

| Invoice value from 50,001 to 100,000 BHD | £600 |

| Invoice value more than 100,000 BHD | £800 |

• For invoices in US dollars or Euro and other currency, these must be evaluated in pounds by multiplying the value of the invoice by the daily exchange rate in order to calculate the fees.

• The Bahrain Embassy will only legalise Certificate of Origin which has been issued on a Bahrain Certificate of Origin, the ABCC will not certify it, courier fees apply.

• The invoice must be certified by the ABCC.

Last updated 14th May 2025

COMOROS DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice

- Certificate of Origin only with a copy of the invoice as a back up

- Other document

Stream 2: NOT APPLICABLE

Last updated 16th august 2021

DJIBOUTI DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice

- Certificate of Origin only with a copy of the invoice as a back up

- Other document

Stream 2: NOT APPLICABLE

Last updated 16th august 2021

IRAQ DOCUMENTATION REQUIREMENTS

Stream 1: Certificate of Origin and Invoice / Other Documents

Stream 2: Certificate of Origin and Invoice / Other Documents + EMBASSY COPY (ODs only)

| Document | Fee |

|---|---|

| Certificate of Origin (Original & Copy) | £100 |

| Invoice (Original & Copy) | £100 |

| All other document (Original & Copy) | £160 |

Legalisation Instructions – Certificate of Origin and Invoice

- The Iraqi Commercial Attaché will only legalise the Certificate of origin and the Invoice, after they have been stamped by the Foreign and Commonwealth Office and the Arab-British Chamber of Commerce.

- The invoice should be issued by a company based in UK and its address should / appear on the invoice and the final destination of the goods should be Iraq in addition the goods full details and total amount should appear as well. Note: Commercial invoice with address outside UK even if it refers to (on behalf of UK address company) is not accepted.

- The commercial invoice should hold one address in UK or Ireland, any extra address (printed or stamped) will not be accepted.

- The Certificate of Origin should include the following details:

- Original /Copy

- Consignor should be a company with full address in UK.

- The consignee should be in Iraq (final destination)

- Invoice number and date should appear in the certificate of origin and should match with the original invoice.

- The origin of the goods should be UK or Ireland, in case of the origin of the goods other than UK or Ireland, the consignor company must submit a letter stating the goods have been produced for their benefit.

- Manufacturer details must appear on the original certificate.

- The Embassy legalise as many copies as the customer wants as long as accompanied with the originals.

- All documents should have a recent date.

- Submit a copy of the packing list related to the documents or a transport document.

- The company should provide a copy of a valid contract if the goods will be supplied to the public sector (governmental companies).

- For medical goods or appliances, an import licence from the Ministry of Trade is required, along with an approval letter from the Ministry of Health.

OTHER DOCUMENTS

- All documents must be presented to the FCDO.

- Embassy copies for all other documents.

Additional requirements

When submitting an OD, please enclose a separate sheet which contains:

• An authorisation letter from the consignor, giving the ABCC permission to submit documents to the embassy on their behalf.

• The letter should include a contact name (passport copy must also be provided) , company name, address, and signature.

For commercial powers of attorney:

When submitting a commercial power of attorney, the director or one of the directors of the UK company must write and sign a letter verifying the authenticity of the power of attorney. The information in the list above must also be stated.

Last updated 22nd April 2022

JORDAN DOCUMENTATION REQUIREMENTS

Steam 1: Certificate of Origin and Invoice / Other Documents

Stream 2: Certificate of Origin and Invoice / Other Documents + EMBASSY COPY

| Document | Fee |

|---|---|

| Certificate of Origin (Original & Copy) | £42.80 |

| Invoice (Original & Copy) | £42.80 |

| All other document (Original & Copy) | £42.80 |

Last updated 22nd March 2023

KUWAIT DOCUMENTATION REQUIREMENTS

Stream 1: Not Applicable

Stream 2: Certificate of Origin and Invoice / Other Documents

| Document | Fee |

|---|---|

| Certificate of Origin (Original & Copy) | £45 |

| Invoice (Original & Copy) | £30 |

| Packing list (Original & Copy) | £45 |

| All other document (Original & Copy) | £15 |

Last updated 16th august 2021

LEBANON DOCUMENTATION REQUIREMENTS

Stream 1: Certificate of Origin and Invoice / Other Documents

Stream 2: Certificate of Origin and Invoice / Other Documents + EMBASSY COPY

| Document | Original | Copy |

|---|---|---|

| Certificate of origin (With only 1 invoice) | £18 | £18 |

| Certificate of origin (With more than 1 invoice) | £36 | £18 |

| Invoice in GBP* | (Invoice value x 4) / 1000 | (Invoice value x 4) / 1000 |

| Invoice in USD* | [(Invoice Value / 1.4) x 4] / 1000 | [(Invoice Value / 1.4) x 4] / 1000 |

| Invoice in other currency* | [(Invoice Value / Current GBP) x 4] / 1000 | [(Invoice Value / Current GBP) x 4] / 1000 |

| Other document | £161 | £161 |

* Invoice Minimum fee: £33.00

* Invoice Maximum fee: £2,233.00

Note: For the rounding of decimals, please round up to the nearest pound

Other Documents (ODs): Agency agreements, documents of information concerning a company, documents appointing a representative of a company in Lebanon and analysis/health certificates all require Foreign, Commonwealth and Development Office (FCDO) Apostille prior to presentation for legalisation.

For ODs issued as court orders to be used in Lebanon, the embassy charges a service fee equivalent to 1% of the amount due.

N.B: Memorandums and Articles are charged separately

Last updated 06th October 2025

LIBYA DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice

- Certificate of Origin only (with a copy of the invoice as a back up)

- Other document

Stream 2:

- Certificate of Origin and Invoice + EMBASSY COPY & TRANSLATION

- Certificate of Origin only (with a copy of the invoice as a back up) + EMBASSY COPY & TRANSLATION

- Other document + EMBASSY COPY & TRANSLATION

| Document | Original | Copy |

|---|---|---|

| Certificate of origin | [(Invoice Value in £) / 1000] + 50 | £50 |

| Invoice | £50 | £50 |

| Other document | £50 | £50 |

- Value of invoice in pound sterling to be typed in box 11 of the Certificate of Origin.

- Legalised documents are required to be translated into Arabic.

- EXPRESS SERVICE – Extra £100.00 per document

Last updated 16th august 2021

MAURITANIA DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice

- Certificate of Origin only with a copy of the invoice as a back up

- Other document

Stream 2:

- Certificate of Origin and Invoice

- Certificate of Origin only with a copy of the invoice as a back up

- Other document

Legalisation free of charge.

All documents must be legalised by the FCDO before submitted to the Embassy.

Last updated 13th December 2023

MOROCCO DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice

- Certificate of Origin only with a copy of the invoice as a back up

- Other document

Stream 2: Not applicable . The embassy legalisation is not required. Instead, all document(s) must be legalised by the FCDO. Note that ABCC certification is still required.

Last updated 16th august 2021

OMAN DOCUMENTATION REQUIREMENTS

Stream 1: Certificate of Origin and Invoice / Other Documents

Stream 2: Certificate of Origin and Invoice / Other Documents

The embassy will not legalise any document that has the FCDO Apostille.

| Document | Original | Copy |

|---|---|---|

| Certificate of origin | £105.00 | £75.00 |

| Invoice | ||

| Invoice $1 - $10,000 | £195.00 | £120.00 |

| Invoice $10,000 - $50,000 | £255.00 | £150.00 |

| Invoice $50,000 - $100,000 | £345.00 | £195.00 |

| Invoice above $100,000 | £495.00 | £270.00 |

| Other Document | ||

| Commercial power of attorney | £225.00 | £225.00 |

| General Power of Attorney | £105.00 | £105.00 |

| Authorisation of Agent | £225.00 | £225.00 |

| Commercial Contract | £165.00 | £165.00 |

| Distribution Agreement | £165.00 | £165.00 |

| Letter of Appointment | £165.00 | £165.00 |

| Article of association | £165.00 | £165.00 |

| Deed of Assignment | £165.00 | £165.00 |

| Registration of company | £165.00 | £165.00 |

| Certificate of declaration | £135.00 | £135.00 |

| Certificate of change of name | £135.00 | £135.00 |

| Certificate of free sale | £135.00 | £135.00 |

| Bank statement | £135.00 | £135.00 |

| Health certificate | £135.00 | £135.00 |

| Certificate of analysis | £135.00 | £135.00 |

| Company act | £135.00 | £135.00 |

| Replacement of lost document | £135.00 | £135.00 |

| Medicine report (personal document) | £75.00 | £75.00 |

| Academic education certificate (personal document) | £75.00 | £75.00 |

| Experience / reference certificate | £135.00 | £135.00 |

| Packing list | £135.00 | £135.00 |

Introduction of Electronic Attestation Service

The Ministry of Foreign Affairs of Oman has introduced an electronic attestation service which is replacing the traditional paper-based attestation service offered by the Consulate. Documents will continue to be submitted to the ABCC for certification and legalisation as normal, and we will complete the electronic attestation.

Please note this applies to all documents for Oman, which includes certificates of origin, invoices, other documents and personal documents.

The Arab-British Certificate of Origin is the only certificate of origin that can be used for the electronic attestation service. Our certification-only service (stream 1) for Arab-British Certificates of Origin for Oman remains unchanged.

Please note that legalisation fees are non-refundable.

Latest update 18/07/2025

PALESTINE DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice

- Other document

Stream 2:

- Certificate of Origin and Invoice

- Other document

| Document | Original | Copy |

|---|---|---|

| Certificate of origin | £120 | £120 |

| Invoice | £120 | £120 |

| Other document | £120 | £120 |

ODs must be legalised by the FCDO before being authenticated by the Mission

Last updated 11th September 2023

QATAR DOCUMENTATION REQUIREMENTS

Stream 1: Not applicable

Stream 2: Certificate of Origin and Invoice / Other Documents

| Document | Original / Copy |

|---|---|

| Certificate of origin | £33 |

| Invoice GBP | |

| 0 - 3,261 | £109 |

| 3,262 - 21,739 | £217 |

| 21,740 - 54,348 | £543 |

| 54,349 - 217,391 | £1,087 |

| above 217,391 | invoice value x 0.006 |

| Invoice EURO | |

| 0 - 4,000 | £109 |

| 4,001 - 26,667 | £217 |

| 26,668 - 66,667 | £543 |

| 66,668 - 266,667 | £1,087 |

| above 266,667 | [(inv value x 3.75) x 0.006] / 4.20 |

| Invoice US DOLLAR | |

| 0 - 4,110 | £109 |

| 4,111 - 27,397 | £217 |

| 27,398 - 68,493 | £543 |

| 68,494 - 273,973 | £1,087 |

| above 273,973 | [(inv value x 3.65) x 0.006] / 4.60 |

| Invoice Q.A.R | |

| 0 - 15,000 | £109 |

| 15,001 - 100,000 | £217 |

| 100,001 - 250,000 | £543 |

| 250,001 - 1,000,000 | £1,087 |

| above 1,000,000 | (inv value x 0.006) / 4.60 |

| Other documents | Original / Copy |

| Health certificate | £22 |

| Export health certificate | £22 |

| Export declaration | £22 |

| Halal certificate | £22 |

| Radiation analysis certificate | £22 |

| Radiation analysis certificate | £22 |

| Environmental certificate | £22 |

| Certificate of free sale | £22 |

| Declaration of origin | £22 |

| Packing list | £33 |

| Other commercial documents | £33 |

Note: For the rounding of decimals, please round up to the nearest pound

- Certificates of Origin (CO) must clearly state the invoice number and date, preferably in Box No. 6 (Remarks).

- The embassy does not accept multiple invoices under one CO unless all invoices share the same invoice number. Each CO must correspond to a single invoice number only.

- For food and drink shipments, it is a requirement that a health certificate, radiation analysis certificate or halal certificate (whichever is applicable) is submitted for legalisation along with the corresponding Arab-British Certificate of Origin and invoice.

- Health certificates, radiation analysis certificates, halal certificates or any other certificates relating to food/drink safety, cannot be submitted for legalisation on their own. They must accompany their corresponding Arab-British Certificate of Origin and invoice, and all three documents are to be legalised.

Last updated 09th July 2025

SAUDI DOCUMENTATION REQUIREMENTS

Stream 1: Certificate of Origin and Invoice / Other Documents

Stream 2: Not applicable

- Other Documents must be apostilled by the FCDO and do not require legalisation.

- ABCC certification and verification remain necessary.

- Documents with liabilities such as contracts, agreements, powers of attorney require supplementary evidence from the signatories of these documents by way of copy of passport from the UK signatory and ID number for Saudi nationals.

Last updated 10th February 2023

SOMALIA DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice

- Certificate of Origin only with a copy of the invoice as a back up

- Other document

Stream 2: Not applicable

Last updated 16th august 2021

SUDAN DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice

- Other document

Stream 2:

- Certificate of Origin and Invoice

- Other document

| Document | Fee |

|---|---|

| Certificate of origin (Original & Copy) | £160 |

| Invoice (Original & Copy) | £160 |

| Other Document (Original & Copy) | £160 |

All ODs submitted for legalisation must be presented to the FCDO.

Last updated 26th April 2023

SYRIA DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice

- Other document

Stream 2: Not applicable

Last updated 16th august 2021

TUNISIA DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice

- Certificate of Origin only with a copy of the invoice as a back up

- Other document

Stream 2:

- Certificate of Origin and Invoice

- Certificate of Origin only with a copy of the invoice as a back up

- Other document

| Document | Fee |

|---|---|

| Certificate of Origin (Original & Copy) | £85 |

| Invoice (Original & Copy) | £85 |

| All other document (Original & Copy) | £85 |

- All documents must be apostilled by the FCDO

Last updated 13th May 2025

UAE DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice only

Stream 2:

- Other document

| Other document (Original & Copy) | Fee |

|---|---|

| Commercial document | £480 |

| Personal document* | £80 |

* Please note that for personal documents, an additional courier fee of £31.20 will apply.

DIGITAL LEGALISATION – OTHER DOCUMENTS

The UAE Embassy has replaced its physical legalisation stamp with a digital attestation service for Other Documents (ODs). Documents will now be digitally signed and include a reference number for verification. The process for submitting documents to the ABCC remains unchanged. Upon completion, you will receive the original document along with a photocopy showing the digital attestation and verification details. This change does not affect the legalisation process for certificates of origin and invoices. Legalisation fees for UAE ODs remain the same.

CERTIFICATES OF ORIGIN AND INVOICES

The UAE Ministry of Foreign Affairs has introduced eDAS 2.0, a digital platform for attesting Arab-British Certificates of Origin and commercial invoices. Only consignees in the UAE can upload these documents, and must register at: https://edas.mofa.gov.ae/regnv2/#/

These documents will now be processed as certification only (stream 1), with legalisation to be completed by the UAE consignee. The process for all other documents remains unchanged (stream 2).

Requirements for Legalisation of Other Documents (ODs)

- All ODs submitted for legalisation must be presented to the FCDO, or other relevant local authority (such as the Governors’ Offices of Jersey, Guernsey & Isle of Man, Irish Apostille, Iceland Apostille – BVI Apostille will still need to be legalised/apostilled by the UK FCDO).

- Power of attorney and similar legal documents must be original and signed in the presence of a UK notary public prior to submission to the FCDO.

Additionally, a statement must be included by the notary practice or solicitor. To meet the requirements of the UK FCDO, it should clearly define the scope of authority being granted. An example of appropriate wording is as follows:

“I, [Full Name of Donor], of [Address], hereby appoint [Full Name of Attorney], of [Address], to be my Attorney for the purpose of [describe specific act or authority], and I authorise them to do anything that I lawfully could do in relation to this matter.”

- A signed company headed letter from the signatory is required to be submitted along with the power of attorney as a supporting document. This letter n e e d s to confirm the following:

• Signatory’s email address

• Signatory’s phone number - Documents apostilled in a bundle are not accepted. They must be attested separately with separate payments.

- Memorandum and articles of association documents must be attested separately with separate payments.

Last updated 18/07/2025

YEMEN DOCUMENTATION REQUIREMENTS

Stream 1:

- Certificate of Origin and Invoice

- Other document

Stream 2:

- Certificate of Origin and Invoice

- Other document

| Document | Original | Copy |

|---|---|---|

| Certificate of origin | £200 | £200 |

| Invoice (over £60,000 an extra £20 for every £10,000) | £400 | £300 |

| Other Document | ||

| Packing list | £200 | £100 |

| General Power of Attorney | £400 | £400 |

| Distribution Agreement | £400 | £400 |

| Commercial Assignment deed | £400 | £400 |

| Certificate of change of name | £400 | £400 |

| Certificate of free sale | £400 | £400 |

| Health certificate | £400 | £400 |

| Medicine certificate | £400 | £400 |

| Certificate of analysis / Conformity | £400 | £400 |

| Company act / Registration of Company | £400 | £400 |

| Certificate of incorporation | £400 | £400 |

| Price certificate | £400 | £400 |

| Certificate of Manufacturer | £400 | £400 |

| Setting up trading agency in Yemen | £400 | £400 |

| Endorsement of contract | £400 | £400 |

| Endorsement of trade mark certificate | £300 | £300 |

| Endorsement of commercial certificate | £300 | £300 |

| Endorsement of quality certificate | £300 | £300 |

| Endorsement of arbitration documents relating to amicable resolution of commercial disputes | £300 | £300 |

| Endorsement of translation of commercial contracts and agreements | £200 | £200 |

| Endorsement of marine transport documents | £400 | £400 |

| Endorsement of cargo manifest | £400 | £400 |

| Court rulings | £200 | £200 |

| Bond resolution | £400 | £400 |

| Letter of credit, banking draft, banking certificate for opening a bank account or confirming existing of a bank account | £400 | £400 |

All ODs submitted for legalisation must be presented to the FCDO, or other relevant local authority (such as the Governors’ Offices of Jersey, Guernsey & Isle of Man, British Overseas Territories).

Last updated 16th august 2021

Arab British Certificate of Origin

An Arab Certificate of Origin is issued for goods that are being sold and permanently exported to Arab League countries. The Chamber uses this unique, bilingual (English/Arabic) Certificate of Origin which conforms to international regulations and is accepted by all governments. Swift processing of documentation is ensured by the Chamber’s nationwide network consisting of Agent Chambers who verify documents prior to submission to the ABCC for certification.

BECOME AN ABCC MEMBER AND GET MORE THAN 50% DISCOUNT ON OUR KEY TRADE SERVICES

ABCC membership provides exclusive networking opportunities such as unlimited complimentary access to most of our high-end events, speaking opportunities, media exposure and various marketing options through our website and publications. Exporters will also benefit from more than 50% reductions in certification fees, discounts on international trade training courses, notary, and translation services, plus discounts on hiring our prime location venue, as well as access to reliable advice on doing business with the Arab world.

Contact us for advice on Trade Documents

If you have any questions about our documentation services and your specific requirements please complete a short online form with your details. A member of our team will then contact you.